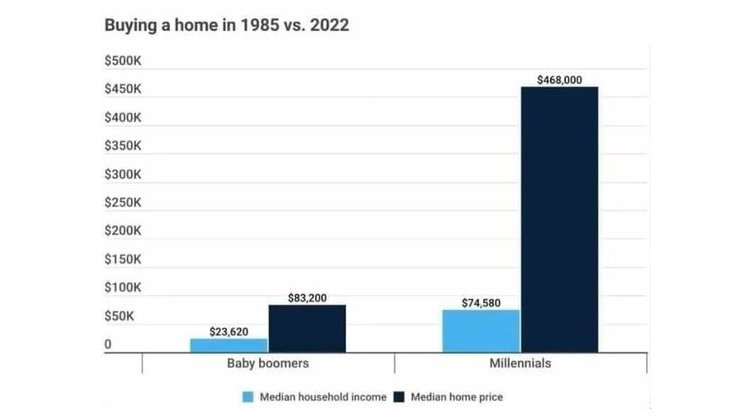

Maybe old weirdos who are mad about young people they'll never even meet choosing not to have kids should worry more about this chart than wokeness

Of course, some old weirdos at least tried to stop this. John Hinkley Jr. comes to mind.

I know times are very tough now. It's sad we have to have a term like "living wage" in our vocabulary.

Union membership is at a historical low.

These days, if you are not in "finance" (making money out of nothing), it's very likely you are in some "service" job (also making money while not making anything).

I think those things are sustained by the fact that US is now a top tier fossil fuel producer. We've fracked our way to #1 in Natural Gas production in the world! (Go USA! Drill, baby, drill!

Of course another possibility is that you are at least partially living off of some 'generational wealth'! Whoopee!

However, I want to balance

@florduh 's

point about expensive housing with a look at the historical interest rates.

Just sayin',1985 might not have been the best year to pick for making the income vs home-pricing comparison.

As we've seen the last 2 years, even a couple of point differential can have a huge impact on the markets, and affordability.

From Bankrate.com,

"Spurred by the Great Inflation, the 30-year fixed mortgage rate reached a pinnacle of 18.4 percent in October 1981, according to Freddie Mac. Once the Fed reined in inflation, the 30-year rate seesawed down to the 9 percent range, closing the decade at 9.78 percent."

Today’s mortgage rates aren’t all that different from the rates of years past. Here’s how they compare.

www.bankrate.com

30 yr rates were about 12% in 1985.

Compared to 2022 rates,

"As the year concluded, the average mortgage rate went from 2.96% in 2021 to

5.34% in 2022."

Current and historical mortgage rate charts showing average 30-year mortgage rates over time. See today's rates in context.

themortgagereports.com

THE 83,200 house in 1985:

856/month × 12 = 10,272,

about 44% of that 23,620 (1985) annual household income

THE 468,000 (same!) house in 2022:

2,730/month X 12 = 32,760,

about 44% of the 74,580 (2022) household income.

Weird, eh?

Having lived through a home purchase in the mid-80's, this whole distinction of rates is to me, a big part of the equation.

I am also aware that these arguments are extremely simplistic; there are so many more layers to this onion....so many more things making it very difficult to even tread water these days.

:

: