-

SCAM WARNING! See how this scam works in Classifieds.

-

The Frolic by Limelight Giveaway is over. Congratulations to the winner: Numerous_Nothing!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs? Buy stuff now?

- Thread starter old-fart

- Start date

chillAtGVC

Well-Known Member

That is what competition is about. If the tariffs go, someone will lower their prices to gain market share from other companies.

Lowering prices always comes at the expense of workers wages and/or quality and safety of the product. Rarely at the expense of dividendes, and not all products are made by companies owned by shareholders.That is what competition is about. If the tariffs go, someone will lower their prices to gain market share from other companies.

I'm not sure Americans wants the same working conditions and salary than Chinese workers.

Competition is one thing, but cooperation is generally more effective and leads to greater achievements.

chillAtGVC

Well-Known Member

Or the removal of tariffs.Lowering prices always comes at the expense of workers wages and/or quality and safety of the product.

Big Swifty

Well-Known Member

Isn't this what a lot of people were upset about during the last US election - that prices didn't drop back to pre-pandemic levels after the pandemic (and related supply issues) was over? One of the big factors in Trump's election win.That is what competition is about. If the tariffs go, someone will lower their prices to gain market share from other companies.

If one company lowers prices today because no more tariffs, everyone else in the market can react by lowering theirs tomorrow to protect market share. Market shares stay the same, all players reduce potential revenues.

I could see a situation where there's a form of passive collusion which leaves prices at their new inflated levels. Market shares stay the same, all players increase revenues and profits.

Or perhaps all players lower their prices to please consumers, but keep prices above pre-tariff levels in order to increase revenues and profits. In this scenario some companies could lower their prices more than others hoping to gain market share, which brings me back to your post in a nice, circular way.

Tariffs and trade wars are complicated. Lotta ins, lotta outs, lotta what have yous.

Last edited:

florduh

Well-Known Member

I could see a situation where there's a form of passive collusion which leaves prices at their new inflated levels. Market shares stay the same, all players increase revenues and profits.

Yep. This is how a lot of post-COVID inflation worked. If the media keeps yelling about "inflation", who is going to double check if a company's input costs actually went up, or if they are simply "taking price"? Well, the same thing will happen with the media talking about tariffs.

Also, this idea that somehow competition is going to kick in and the corpos will need to eat the cost of tariffs is very optimistic. Some might say delusional. There's been so much corporate consolidation over the last few decades...that sort of wonderful free market competition is gone with the wind:

chillAtGVC

Well-Known Member

I think you are conflating two different things. One is price increases driven by input cost increases (higher tariffs to import inputs to your business. The other is price increases caused by inflation caused by increases in the money supply without corresponding increases in value produced (aka printing money out of thin air). In the first, the price can be reduced if the input cost reduces. Look at the price of a colour tV over the past 40 years. The second will never go down unless the money supply is tightened or if a deflationary market happens.

florduh

Well-Known Member

(aka printing money out of thin air)

Prices were jacked up post COVID across the planet because COVID collapsed the global supply chain (or because companies were simply taking advantage of the situation). "The Money Supply" barely made a blip compared to those two factors.

Also...given that the vast majority of the money we printed ended up in the hands of the very wealthy, the best way to shrink the "money supply" would be to soak the rich with new taxes. Yet nobody who cries about "printing money" ever proposes that. Curious

Flotsam

Well-Known Member

For some reason i keep l keep lists of things on both ebay and Amazon in a cart. Most will probably not be purchased, but they give you a nice total summary on how much that shopping cart would be to check out. By my calculation prices have risen a bit over 21 % in last few months. and now likely to be even higher coming up. Already seeing layoffs in trucking ( transportation in general).

a cnn business article :

USPS briefly stopped delivering parcels from China. Delivery times for parcels that did get shipped stretched longer, with limited information on package tracking in the US.

At the heart of the issue: the sheer volume of packages. More than 80% of total US e-commerce shipments in 2022 were de minimis imports, the vast majority of which come from China, according to a congressional research report.

a cnn business article :

USPS briefly stopped delivering parcels from China. Delivery times for parcels that did get shipped stretched longer, with limited information on package tracking in the US.

At the heart of the issue: the sheer volume of packages. More than 80% of total US e-commerce shipments in 2022 were de minimis imports, the vast majority of which come from China, according to a congressional research report.

Rodney

Well-Known Member

My body building powder went from £30 to £40 on Amazon and that is now the RRP of it.

Also exactly what @Flotsam just said all my shopping lists and things left in cart have went way up in price. For example a weight bar that cost £35 is now £49 and a warm mist dehumidifier was £30 now £43, short wave radio balun was £9.99 now £11, BNC small connectors ALWAYS costed £4.99 for as long as I remember and now cost £6.95.

The only 1 thing that has not went up in price from what I can see is the Ashwagandha that i bought a year ago at £6.99 and is still same price.

ALSO a lot of the smaller stores on Amazon that shipped from china and sold china makes of Arial wires and connectors that i use for my radios have disappeared from Amazon.

All my lcoal shopping adn take away shops have not went up in price yet so there is that.

Also exactly what @Flotsam just said all my shopping lists and things left in cart have went way up in price. For example a weight bar that cost £35 is now £49 and a warm mist dehumidifier was £30 now £43, short wave radio balun was £9.99 now £11, BNC small connectors ALWAYS costed £4.99 for as long as I remember and now cost £6.95.

The only 1 thing that has not went up in price from what I can see is the Ashwagandha that i bought a year ago at £6.99 and is still same price.

ALSO a lot of the smaller stores on Amazon that shipped from china and sold china makes of Arial wires and connectors that i use for my radios have disappeared from Amazon.

All my lcoal shopping adn take away shops have not went up in price yet so there is that.

chillAtGVC

Well-Known Member

Looks like good news for UK customers of US made vapes today!

Flotsam

Well-Known Member

maybe i suppose but so many vaporizers are made in "Chyna" it may be hard to say what happens. Glad your new PM mentioned Canada is not for sale, but Denmark might have to be worried about Greenland.........Looks like good news for UK customers of US made vapes today!

Rodney

Well-Known Member

I see some people saying the UK will have it good with this deal forgetting that this deal is with this mahogany coloured maniac who has to hacve scaffolding put around his head to get his hair in place each day. He makes jabba the hutt look like a nice guy.

So now all the people who wanted to leave the EU are saying this is what we left for to get this big deal with the USA that would not have happened if we stayed in the EU..........

Any deal with this guy is a bad deal even if it seems good at the time. I mean we would not even have to be making a deal if it was not for this guy and all his messing everyone about.

Also none of this helps me with the things I and most here want from China.

Oh one thing the deal we have made with India should be good for a lot of the gadgets and electronics I like to buy so there is that.

So now all the people who wanted to leave the EU are saying this is what we left for to get this big deal with the USA that would not have happened if we stayed in the EU..........

Any deal with this guy is a bad deal even if it seems good at the time. I mean we would not even have to be making a deal if it was not for this guy and all his messing everyone about.

Also none of this helps me with the things I and most here want from China.

Oh one thing the deal we have made with India should be good for a lot of the gadgets and electronics I like to buy so there is that.

chillAtGVC

Well-Known Member

How does that have anything to do with the American tariffs?Also none of this helps me with the things I and most here want from China.

Rodney

Well-Known Member

How does that have anything to do with the American tariffs?

The American Tariffs affect the price and availability of goods coming to the UK from China. True they are American Tariffs (or should i say Trump Tariffs) but they are affecting prices and availability of goods everywhere.

florduh

Well-Known Member

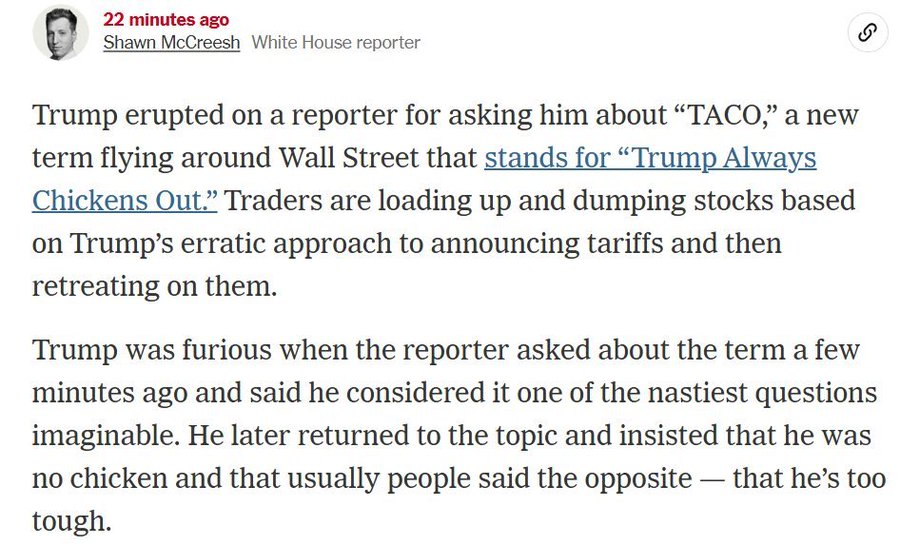

Total and complete Chinese victory

www.bbc.com

www.bbc.com

By the way, no kidding the stock market is going crazy. Prices will still go up. There's been a month long supply chain disruption for no reason. But now, even when input costs return to pre-tariff levels, prices will remain at their new highs. Only now the money won't go towards paying down "the debt" or bolstering domestic manufacturing. No, now the corpos will simply pocket extra profits.

China wins

American oligarchs win

American workers lose

Art of the Deal!

Trump says US-China relations 'reset' as markets surge on tariff pause

The 90-day pause is a major de-escalation in the tariff war and comes after talks between both countries in Geneva.

By the way, no kidding the stock market is going crazy. Prices will still go up. There's been a month long supply chain disruption for no reason. But now, even when input costs return to pre-tariff levels, prices will remain at their new highs. Only now the money won't go towards paying down "the debt" or bolstering domestic manufacturing. No, now the corpos will simply pocket extra profits.

China wins

American oligarchs win

American workers lose

Art of the Deal!

Bakin4Life

Oink

Not to mention that the markets continue their whipsawing back and forth with each 'new' decision to impose / suspend tariffs. And if you know the timing of the events, you're set to make a LOT of money in puts / calls. Just like what happened a couple of weeks ago.

So glad I fled to safety, before Clownface Von Fuckstick got reinstalled.

Of course, the FDIC may go tits up before (if) he leaves, but I've still got a mattress I can stuff.

So glad I fled to safety, before Clownface Von Fuckstick got reinstalled.

Of course, the FDIC may go tits up before (if) he leaves, but I've still got a mattress I can stuff.

florduh

Well-Known Member

Even before we hiked up prices for no reason, the majority of Americans don't make enough to maintain a "minimal quality of life"

www.cbsnews.com

www.cbsnews.com

The President making everything I buy 10-40% more expensive for no good reason will just make me grind harder

That's what you Libs don't understand

Most Americans don't earn enough to afford basic costs of living, analysis finds

The bottom 60% of U.S. households don't make enough money to afford a "minimal quality of life," according to a new analysis.

The President making everything I buy 10-40% more expensive for no good reason will just make me grind harder

That's what you Libs don't understand

Rodney

Well-Known Member

YES!!!!!

www.bbc.co.uk

www.bbc.co.uk

Trump tariffs get to stay in place for now. What happens next?

It came a day after a previous ruling temporarily blocked many of the administration's sweeping trade tariffs.