-

SCAM WARNING! See how this scam works in Classifieds.

-

The Frolic by Limelight Giveaway is over. Congratulations to the winner: Numerous_Nothing!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New York's Medical Marijuana Program Shows Some Signs of Life

- Thread starter Nesta

- Start date

teabelly

Well-Known Member

This has turned out to be such a ClusterF. If it ever happens it will be a miracle. Between the politics and dissension, everyday is a new story.

Of course they want the estimated 300 million in tax revenue to go to the NY city subway system which many oppose, and NY is treating this like they're the first state to do this, "oh what will we do and how will we regulate it." And plus they just said if it does go to a vote (which won't be this year) they'll put in the bill that counties can choose what they want to do and many have said they won't allow stores. This just keeps getting better all the time.

Of course they want the estimated 300 million in tax revenue to go to the NY city subway system which many oppose, and NY is treating this like they're the first state to do this, "oh what will we do and how will we regulate it." And plus they just said if it does go to a vote (which won't be this year) they'll put in the bill that counties can choose what they want to do and many have said they won't allow stores. This just keeps getting better all the time.

Marijuana Testing of Job Applicants Is Barred by City in Groundbreaking Measure

The bill passed by the New York City Council was the latest in a series of steps to ease cannabis restrictions as efforts to legalize marijuana have stalled.

The bill passed by the New York City Council was the latest in a series of steps to ease cannabis restrictions as efforts to legalize marijuana have stalled.

Tranquility

Well-Known Member

New York governor want legal weed.

https://thehill.com/homenews/state-...ges-to-legalize-marijuana-in-new-york-in-2020

https://thehill.com/homenews/state-...ges-to-legalize-marijuana-in-new-york-in-2020

New York Gov. Andrew Cuomo (D) during his Wednesday night State of the State address pledged to legalize marijuana in New York by the end of this year.

Cuomo had said legalization was a priority in his agenda in 2019, but a push for legalization failed to pass in the state legislature before the end of the legislative session.

“For decades, communities of color were disproportionately affected by the unequal enforcement of marijuana laws,” Cuomo said in his address, according to The New York Times. “Let’s legalize adult use of marijuana.”

Cuomo’s pledge for legalization comes as the state faces a $6 billion budget gap, the Times notes. ...

Cuomo had said legalization was a priority in his agenda in 2019, but a push for legalization failed to pass in the state legislature before the end of the legislative session.

“For decades, communities of color were disproportionately affected by the unequal enforcement of marijuana laws,” Cuomo said in his address, according to The New York Times. “Let’s legalize adult use of marijuana.”

Cuomo’s pledge for legalization comes as the state faces a $6 billion budget gap, the Times notes. ...

BigJr48

Well-Known Member

Didn't Gov. Cuomo proposed this same agenda when he was running for reelection?New York governor want legal weed.

https://thehill.com/homenews/state-...ges-to-legalize-marijuana-in-new-york-in-2020

New York Gov. Andrew Cuomo (D) during his Wednesday night State of the State address pledged to legalize marijuana in New York by the end of this year.

Cuomo had said legalization was a priority in his agenda in 2019, but a push for legalization failed to pass in the state legislature before the end of the legislative session.

“For decades, communities of color were disproportionately affected by the unequal enforcement of marijuana laws,” Cuomo said in his address, according to The New York Times. “Let’s legalize adult use of marijuana.”

Cuomo’s pledge for legalization comes as the state faces a $6 billion budget gap, the Times notes. ...

Tranquility

Well-Known Member

But, with this damn war and that lying son of a bitch Johnson...who has the time?Didn't Gov. Cuomo proposed this same agenda when he was running for reelection?

New York Will Legalize Marijuana By April And Regulate CBD-Infused Drinks, Governor’s Advisor Says

The top marijuana advisor to New York Gov. Andrew Cuomo (D) says cannabis legalization legislation will again be introduced through the state budget in January, with the goal being to enact the reform by April. He also previewed state regulations for hemp-derived CBD products, including allowing infused drinks and food items.

This is scary actually. I envision some mafioso style crackdowns on “non-licensed” grows that cant afford the $1 million+ fees for licensing and politician pocket-lining.But I’ll pray for the best.

If NY doesn’t introduce a bill that will allow personal grow you better believe it’s just another front for wealthy corporations to leach off residents and tourists.

Sorry for the pessimistic attitude but I’ve lived here long enough and seen so much bull crap that this headline hardly cheers me up at this point.

If NY doesn’t introduce a bill that will allow personal grow you better believe it’s just another front for wealthy corporations to leach off residents and tourists.

Sorry for the pessimistic attitude but I’ve lived here long enough and seen so much bull crap that this headline hardly cheers me up at this point.

This is scary actually. I envision some mafioso style crackdowns on “non-licensed” grows that cant afford the $1 million+ fees for licensing and politician pocket-lining.But I’ll pray for the best.

If NY doesn’t introduce a bill that will allow personal grow you better believe it’s just another front for wealthy corporations to leach off residents and tourists.

Sorry for the pessimistic attitude but I’ve lived here long enough and seen so much bull crap that this headline hardly cheers me up at this point.

Nothing to be sorry for. I had much more pessimistic thoughts when I first saw the article but figured I'd probably be better keeping them to myself

Gunky

Well-Known Member

It's happening the same way almost everywhere if it's any consolation. The California "legalization" measure was also a crock designed to grab and keep grow and sell rights for monied interests. Most of them have strange, irrational plant limits, possession limits, transportation limits, and tax the livin' daylights out of the industry. Oh well.

The question is, will they make flower legal in this new legislation?

Making it legal is worthless (to me) if it doesn’t include flower.

I think they would HAVE to. If they're talking about recreational legalization anyway.

Not that I agree with it at all, but I could ALMOST, if I really try, maybe start to sort of, kind of, see a hint of a logical explanation for not allowing combustion for medical reasons. Like maybe they couldn't determine if burning plant matter would cause more harm than good bc of fed regs preventing actual medical studies? Idk. I never remotely understood NY medical program.

If flower's status doesn't change, I agree, it is completely worthless. I can imagine a rec program without flower though.

Then again, its Cuomo. Nothing his office does at this point surprises me. We'll get recreational 2.5mg edibles. 2 per customer.

Jill NYC

Portable Hoarder

Could New York's limited medical cannabis program hamper a new adult-use market?

New York's restrictive medical marijuana program could hamper the state's potential transition to a commercial recreational cannabis market.

Anyone know about this exception for flower vaping? First I ever heard of it. And obviously it isn’t very well thought out.

“New York does allow a ground flower product for vaping, but even that recently encountered a regulatory hurdle.

About two months ago, Curaleaf had to recall product “after a recent complaint over the size of our flower, which the Department of Health claimed was too large,” according to Patrik Jonsson, Curaleaf’s regional president in the Northeast.

Jonsson and Montag both noted the state and Curaleaf have since resolved the issue, and Curaleaf now is allowed to resume production of a more finely ground flower.”

bulllee

Agent Provocateur

Could New York’s limited medical cannabis program hamper a new adult-use market?

Published 13 hours ago | By Jeff Smith

Editor’s note: Get up-to-date insights on state ballot initiatives and all things Election 2020 for cannabis at MJBizCon. We start with Election Week | November 2, 2020 & November 4, 2020.

New York could potentially become one of the biggest marijuana markets in the world, but its existing medical cannabis program is heavily regulated and has experts questioning how a possible adult-use market would fare.

Gov. Andrew Cuomo wants to steer adult-use legalization through the state Legislature by next spring.

And next week’s legalization vote in New Jersey likely will only increase pressure on New York to do so, if not hasten the timeline.

But a strong transition to a commercial recreational marijuana market in New York could be hampered by the fact the state’s MMJ program remains one of the most restrictive in the country. Hurdles include a ban on smokable flower, limited licenses, a relatively small number of dispensaries and patient-access issues.

“It’s certainly going to be challenging for New York,” said Rob DiPisa, co-chair of the cannabis law group at New Jersey-based Cole Schotz.

New Jersey has been expanding its MMJ program, DiPisa noted, “while New York has really been stagnant. There hasn’t been a lot of activity there, and because of that, there aren’t a lot of operators online.

“So when New York flips to adult use, I think they are going to have even a harder time than New Jersey will to meet the demand, which … could just permit the black market to continue to thrive in the New York area.”

Few companies … large population

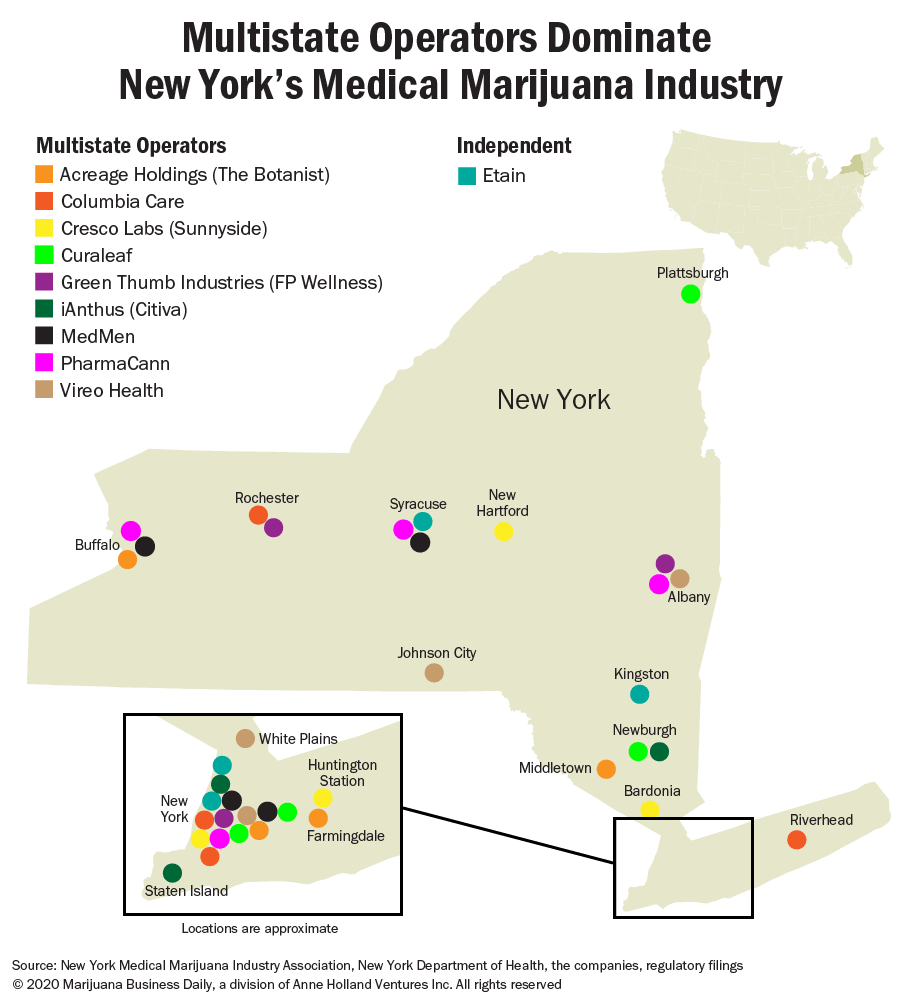

New York has only 10 vertically integrated MMJ operators, each allowed to operate four dispensaries.

That’s despite a population of around 20 million and more than 65 million tourists annually before the coronavirus hit.

As of Oct. 20, 128,718 patients were certified to receive medical marijuana, according to New York Department of Health figures.

The 2020 Marijuana Business Factbook projects that New York MMJ sales will reach $60 million to $70 million this year, despite the state’s huge population (see chart above).

By comparison, Florida – which started its MMJ program at about the same time as New York and has roughly the same population – features 435,000 patients, 286 dispensaries and projected annual sales of more than three-quarters of a billion dollars.

In the past 20 months, Florida has lifted bans on smokable flower and edibles.

Cuomo wanted to legalize adult use last spring through his budget bill but abandoned the effort because of the coronavirus pandemic.

The governor is beginning to push hard again, as coronavirus impacts have exacerbated a multibillion-dollar budget deficit.

Public sentiment for recreational legalization is strong: 61% favor legalization and only 30% are opposed, according to a poll this month by Spectrum News/Ipsos.

New York’s existing MMJ operators believe they have a good argument to be granted first entry into the adult-use market.

“I struggle to conceive of a different way of rolling out an adult-use program in New York that still accomplishes the goal … of generating immediate revenue,” said Jeremy Unruh, senior vice president of public and regulatory affairs for Illinois-based PharmaCann.

But they’ll need to persuade Cuomo and New York lawmakers.

YaMon

Vaping since 2010

The fucktards are too caught up worrying about lost revenue to home growing, but they haven't a clue as to what additional business opportunities home growing would bring in addition to how difficult it is to grow dispensary quality and variety bud at home. It's short sighted and they'll lose the revenue to neighboring states.

Legal weed delivered to your door? Cuomo’s marijuana plan now includes it

Imagine not just being able to buy legal marijuana, but having it delivered straight to your door.

Gov. Andrew Cuomo has added the option of home delivery to his latest proposal for legalized, adult-use recreational marijuana in New York. Local governments would have the ability to opt out of allowing delivery within their jurisdictions.

jbm

Well-Known Member

There's already MMJ delivery here, the problem is that there's nothing being sold worth having delivered.Imagine not just being able to buy legal marijuana, but having it delivered straight to your door.

Summer

Long Island, NY

23 years ago when Cuomo initially proposed legalization, both Suffolk & Nassau Counties said they would opt out of allowing dispensaries. My guess is they'll also opt out of delivery. Besides, the closest dispensaries will be in Queens, which would be too costly for delivery.

From same article:

"Some critics have faulted Cuomo’s plan for creating a too highly regulated sales and production operation that would favor large businesses over smaller ones, and for not making provisions for home-grown marijuana."

The aforementioned will put donor $ in his pocket & the latter will take $ out of residents' pockets. Typical Cuomo. Hopefully, his reign is ending soon. What he did in the nursing homes (to patients & staff) & to families is criminal.

From same article:

"Some critics have faulted Cuomo’s plan for creating a too highly regulated sales and production operation that would favor large businesses over smaller ones, and for not making provisions for home-grown marijuana."

The aforementioned will put donor $ in his pocket & the latter will take $ out of residents' pockets. Typical Cuomo. Hopefully, his reign is ending soon. What he did in the nursing homes (to patients & staff) & to families is criminal.

Last edited:

There's already MMJ delivery here, the problem is that there's nothing being sold worth having delivered.

Yeah, if we haven't noticed, the media does anything they can to shine a positive light on him.

@Summer agreed on your sentiments entirely - but when it comes to the LI counties, I'm a little hopeful they would be more accepting this time around. Typically Westchester and LI seem to run hand in hand...I have very low expectations and zero faith, but would be happy to eat my own words if it turns out to be something worthwhile.

Marlon Rando

Well-Known Member

He's providing 'Medical relief' for his patients. When Clowns try and act like Goodfellas, accidents tend to occur.What he did in the nursing homes (to patients & staff) & to families is criminal.

He's got he's hands full this week with the bootlicking Presstitutes.Yeah, if we haven't noticed, the media does anything they can to shine a positive light on him.

Last edited:

jbm

Well-Known Member

Yeah, for some odd reason I don't think you're going to see dispensaries in Larchmont once this goes through. The MMJ program is already so messed up as it is, almost no selection and what's there is ridiculous, what's with the strain name abbreviations? And only ground flower?Typically Westchester and LI seem to run hand in hand...I have very low expectations and zero faith, but would be happy to eat my own words if it turns out to be something worthwhile.

I wonder if MMJ will be exempt from the rec taxes like in MA.

Yeah, for some odd reason I don't think you're going to see dispensaries in Larchmont once this goes through. The MMJ program is already so messed up as it is, almost no selection and what's there is ridiculous, what's with the strain name abbreviations? And only ground flower?

I wonder if MMJ will be exempt from the rec taxes like in MA.

Not a shot in hell Larchmont will allow a dispo lol. They would be up in arms. Funny though, I get my haircuts in Larchmont.

Yeah, I've never even seen the "ground flower" they offer now, but I've heard its ground so fine its not even useful for anything. I guess since its illegal to actually smoke it, they dont want you to buy pre ground and be able to roll it up? That logic just really escapes me. Without even getting into the rest of the "selection" issues and lack of any decent product. Basically the only thing semi-worth buying is the oil carts

I'm curious about the taxes too. My guess it will be astronomical on top of already over priced product. They're better off just wiping the slate clean, scrapping the current program entirely and starting from scratch. Even if it takes a few more years. I dont understand the current program, the consumer end of it is a complete joke and I can only imagine the producer side of it.

jbm

Well-Known Member

Even the carts. Lousy selection, about the only ones worth considering are the Select Live Oil, but why hide the strain names? The Etain carts are stupid with no strain info and the Forte/Dulce crap. I have a card and I almost never buy anything. Also it’s nuts that you can’t grow.Basically the only thing semi-worth buying is the oil carts